Have you ever wondered how businesses today keep their accounts in check with precision and efficiency? The answer is using robust cloud-based accounting software.

Gone are the days of tedious bookkeeping and manual data entry. Now, businesses are swiftly moving to the cloud to manage their accounting data effectively.

With cloud-based accounting software, businesses can leverage unparalleled convenience and flexibility to access accounting data anytime, anywhere.

Whether you are a small startup or a large enterprise, you can benefit from this platform. It transforms how companies handle their accounting operations, helping them make informed decisions, stay compliant, and drive their business forward.

This post will provide exclusive insights into how cloud-based accounting software can revolutionize your account management, boost productivity, and set you on the path to success.

Ready to unlock the potential of your business with the power of cloud-based accounting software?

Let’s begin!

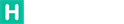

The Role of Accounting Software in Small Business

Streamlining Financial Processes

Accounting software automates routine tasks like bookkeeping, invoicing, and payroll, ensuring accuracy and saving time. Automation reduces the manual workload, allowing employees to focus on more strategic tasks.

For instance, automated invoicing ensures

- Invoices are sent out on time

- Reducing the likelihood of late payments

- Improving cash flow

The software can also schedule recurring payments and generate financial statements with minimal input, providing a seamless account management experience.

Enhancing Accuracy and Compliance

Accounting software reduces human error and ensures financial records are precise and compliant with accounting standards and regulations. This is essential to avoid penalties and potential legal issues.

To ensure compliance, cloud-based accounting software often includes features like

- Tracking tax obligations

- Generating compliance reports

- Ensuring adherence to financial regulations

The platform catches accounting discrepancies early, preventing errors from escalating into significant financial problems.

Facilitating Informed Decision-Making

Real-time access to accounting information is crucial for businesses to make informed decisions quickly. Accounting software provides comprehensive reports and analytics, helping managers understand financial health and forecast future trends.

These tools offer insights into profitability, cost control, and financial performance, enabling business leaders to make data-driven decisions.

Software with intuitive dashboards and visualizations simplifies the interpretation of complex financial data, ensuring that decision-makers clearly understand the company’s economic status.

Improving Cash Flow Management

Timely invoicing and efficient tracking of expenses and revenues improve cash flow management. Accounting software helps businesses monitor their financial inflows and outflows, ensuring they have sufficient liquidity to meet their obligations.

Features such as

- Cash Flow Forecasting: It allows businesses to predict future cash positions and plan accordingly.

- Alerts for Overdue: It sends alerts for overdue invoices and upcoming bills that help maintain a healthy cash flow

Such features ensure businesses can cover operational costs and invest in growth opportunities.

Boosting Productivity

By automating repetitive financial tasks, accounting software saves time and effort of your team. It allows them to focus on more strategic activities rather than working on mundane tasks. Ultimately, it leads to improved productivity, increased efficiency, and better business outcomes.

For example, employees can dedicate more time to analyzing accounting data and developing growth strategies instead of spending hours on manual data entry.

Additionally, streamlined processes reduce the likelihood of burnout and increase job satisfaction, leading to a more motivated workforce.

Enhancing Collaboration

The software allows multiple users to access accounting data and work on it simultaneously from different locations. Businesses with remote teams or multiple offices can experience improvement in cross-team collaboration.

Features such as user permissions and role-based access protect sensitive data while allowing for collaborative efforts.

Using cloud-based accounting software, teams can work together on

- Financial planning

- Budgeting

- Reporting and more

Allowing everyone to work simultaneously, the software improves transparency and communication across the departments.

Effective Lottery Management

For the businesses involved in lotteries, accounting software tracks and manages lottery funds accurately. It ensures financial and legal regulations compliance, providing a transparent and accountable system.

The software can handle ticket sales, prize payouts, and fund allocations, ensuring that all transactions are recorded and reported accurately.

This transparency is crucial in lottery management. It maintains trust with participants and regulatory bodies and ensures that all funds are managed ethically and efficiently.

Integration with 3rd Party Tools

Advanced accounting software can seamlessly integrate with other business tools, such as CRM systems, e-commerce platforms, and project management software. This integration creates a cohesive ecosystem, enhancing overall business efficiency and data accuracy.

For example,

- Integrating accounting software with CRM

Integrating accounting software with a CRM system can provide a comprehensive view of customer transactions, improving sales forecasting and customer relationship management.

- Integrating accounting software with an e-commerce platform

Integration with e-commerce platforms ensures sales data is automatically recorded in the accounting system, reducing manual data entry and minimizing errors.

By incorporating these functionalities, accounting software plays a vital role in managing business finances effectively, driving growth, and ensuring long-term success.

6 Advantages of Cloud-Based Accounting Software

Cloud-based accounting software has revolutionized how businesses manage their accounting operations. Here are some of the key advantages:

Accessibility and Flexibility

One of the most significant benefits of cloud-based accounting software is the ability to access essential financial data anytime, anywhere. It allows you to manage your accounts from the office, home, or on the go, using any device with internet access.

It delivers more value to businesses with remote teams or multiple locations, ensuring everyone can stay up-to-date and collaborate efficiently.

Cost Efficiency

Traditional accounting systems often require substantial upfront investment in hardware, software, and ongoing maintenance. On the other hand, cloud-based solutions operate on a subscription basis, reducing initial costs and spreading expenses over time.

Additionally, there is no need for expensive IT infrastructure or dedicated IT staff to manage the system, leading to savings.

Scalability and Customization

If you’re a startup or a large-scale organization, cloud-based accounting software offers the flexibility to scale up or down the solution based on your needs.

Customizable modules and features allow businesses to meet their specific requirements, ensuring they only pay for what they need and can add more functionalities as they expand.

Security and Reliability

Ensuring the security of the accounting data is crucial for every business. Thus, cloud-based accounting software providers invest heavily in advanced security measures such as

- Encryption

- Multi-factor authentication

- Regular security audits and more

Implementation of these security measures ensures the protection of sensitive financial information.

Cloud services often include automatic backups and disaster recovery plans, ensuring your data is safe and allowing you to restore it quickly in an emergency.

Real-Time Updates and Reporting

The accounting software provides real-time access to accounting data, allowing businesses to monitor their economic health continuously.

This real-time reporting capability ensures you have the most up-to-date information, enabling quicker and more informed decision-making.

Generating accurate financial reports on demand helps track performance, forecasting, and strategic planning.

Automatic Updates and Maintenance

Unlike traditional software that requires manual updates and maintenance, cloud-based solutions are automatically updated by the vendors.

It means businesses always have access to the latest solution features, security patches, and improvements without additional effort. Automatic updates also minimize downtime and ensure that the software runs smoothly.

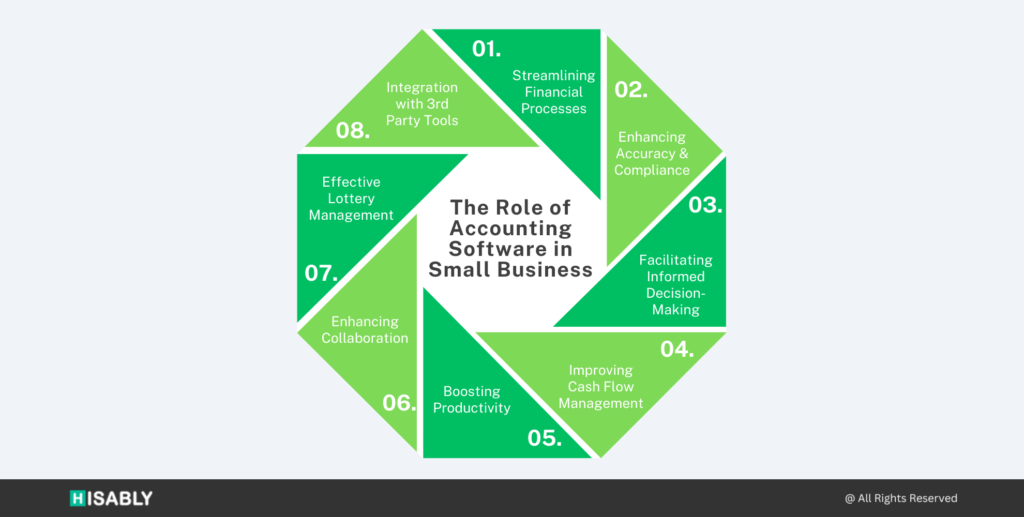

Why is Hisably the Right Choice?

Selecting the right cloud-based accounting software is essential for smoothly performing accounting operations. Eventually, it helps improve productivity and reduce operational costs.

Hisably is the best cloud-based accounting software that facilitates companies with advanced features and capabilities that empower the operations of small businesses:

Advanced Financial Analytics

Hisably provides powerful analytics and reporting tools that give businesses deep insights into their financial health.

With a customized dashboard and real-time data, you can

- Monitor key performance indicators

- Track trends

- Make informed strategic decisions

Based on this analysis, you can drive ensured growth and success.

Automated Processes

Unleash Hisably’s full potential to automate your critical accounting functions, such as invoicing, payroll, expense tracking, and tax calculations.

Automation reduces the time spent on mundane tasks, minimizes errors, and ensures that your financial data is always up-to-date and accurate.

Scalable Solutions

Whether you’re a small startup or a growing enterprise, Hisably scales with your business. The software offers flexible modules and features that can be added as your needs evolve, ensuring you always have the right tools without paying for unnecessary extras.

Robust Security Measures

Hisably employs advanced security protocols to protect your accounting data. With data encryption, secure user authentication, and regular backups, you can be confident that your sensitive information is safeguarded against threats.

Real-Time Collaboration

With Hisably, multiple users can access and work on financial data simultaneously. This facilitates seamless collaboration among team members. It also helps businesses with remote staff or various departments, ensuring everyone stays aligned and productive.

Customizable Reports

Hisably offers a wide range of customizable reporting options, allowing you to generate detailed financial reports tailored to your specific needs. Whether you need standard financial statements or specialized reports for specific projects or departments, Hisably generates the report to provide insights.

Integrated Ecosystem

Hisably integrates seamlessly with other business tools like project management software, e-commerce platforms, CRM systems, etc. This integrated approach ensures that all your business processes are connected, enhancing efficiency and reducing the risk of data silos.

Conclusion

Hisably stands out as the ideal accounting software, offering intuitive design, advanced analytics, automation, scalability, and robust security. It’s tailored to meet businesses’ diverse needs, ensuring efficient accounting management and strategic growth.

Ready to transform your accounting operations and drive your business forward?

Talk to our expert to discover how Hisably can perfectly fit your business needs.

Take your first step towards accounting excellence.