Managing day-to-day accounting operations manually can be tedious, time-consuming, and error-prone for convenience stores. Cloud-based accounting software can come to the rescue.

The emergence of accounting technology has transformed how convenience store owners manage their finances, offering unprecedented flexibility, efficiency, and accessibility. As the industry continues to evolve, embracing an advanced accounting platform is no longer an option – it’s a strategic imperative for convenience store owners who want to thrive in the digital age.

The Rise of Cloud-Based Accounting in Convenience Stores

Convenience stores have long been the backbone of local communities, providing essential goods and services to customers on the go. However, managing the financial aspects of a convenience store operation has traditionally been a time-consuming and labor-intensive task.

Manual bookkeeping methods and outdated accounting software often led to inefficiencies, errors, and missed growth opportunities.

Leveraging the accounting system, convenience store owners have automated and improved their approach to financial management. By moving their accounting operations to the cloud, store owners gain access to a wide range of benefits that were previously out of reach.

Top 5 Benefits of Cloud-Based Accounting Software for Convenience Stores

Enhanced Accessibility and Flexibility

The accounting system allows C-store owners to access their financial data from anywhere with internet connectivity. Whether they are at the store, at home, or on the road, store owners can log in to their accounting system and view real-time financial information.

This level of accessibility empowers store owners to respond quickly to changing market needs, make informed decisions, and gain a competitive edge.

Improved Efficiency and Automation

One of the most significant benefits of cloud-based accounting is its ability to streamline workflows and automate repetitive tasks.

Tasks that once required hours of manual effort, such as data entry, reconciliations, and report generation, can now be done in less time with the click of a button. It saves store owners valuable time, minimizes errors, and allows resources to focus on more strategic aspects of running the business.

Scalability and Growth Opportunities

As convenience stores expand, their accounting needs evolve as well. Accounting solution offers scalability, allowing store owners to adapt to business changes without costly upgrades or infrastructure investments.

Whether opening new locations, expanding product offerings, or increasing sales volumes, cloud-based accounting can scale to meet the needs of a growing convenience store operation.

Data Security and Compliance

Security is the highest priority when it comes to financial data, especially in industries as heavily regulated as convenience retail. Accounting software employs robust security measures, including encryption, data backups, and multi-factor authentication, to ensure that sensitive information remains safe and secure.

Additionally, many cloud-based accounting systems are designed to help store owners stay compliant with industry regulations, tax requirements, and reporting standards, providing peace of mind and minimizing the risk of fines or penalties.

Seamless Cross-Team Collaboration

Seamless cross-team collaboration in accounting solution allows different departments of convenience stores to access and update financial data in real-time.

This interconnected approach ensures that inventory, sales, and financial reporting are consistently synchronized, enhancing communication and decision-making. It streamlines operations, reduces errors, and supports a unified strategy for managing day-to-day activities and long-term planning.

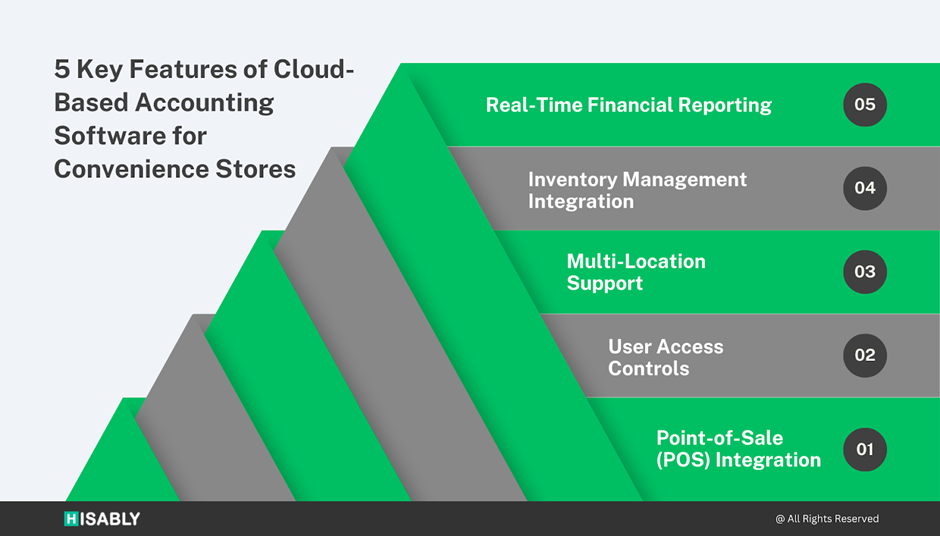

5 Key Features of Cloud-Based Accounting Software that Convenience Stores Should Consider

For convenience stores looking to streamline their financial operations, an accounting system offers a range of essential features designed to optimize efficiency, accuracy, and strategic oversight.

Here are five must-have features of such accounting software with detailed explanations of each:

Real-time Financial Reporting

Accounting software allows C-store managers to access financial data in real time. This allows store managers to monitor sales figures, expenses, and profit margins as transactions occur.

The real-time availability of accounting information facilitates quick decision-making and timely adjustments to store operations, which is crucial for responding to fast-changing market conditions.

Inventory Management Integration

Effective inventory management is vital for convenience stores to ensure product availability and minimize overstocking.

Cloud-based accounting software that integrates inventory management helps track stock levels automatically as sales are made. This integration supports optimal stock replenishment, prevents loss from expired goods, and helps plan promotions based on inventory insights.

Multi-Location Support

Many convenience store chains operate from multiple locations, necessitating a unified view of financial operations across all sites. Cloud-based accounting systems with multi-location support allow centralized account management, consolidating financial data from various stores.

This feature helps maintain consistency in pricing, manage inter-store transfers, and compile comprehensive financial reports that reflect the health of the entire business.

User Access Controls

User access controls are essential for maintaining the integrity and security of financial data in convenience stores. This feature allows store owners to set permissions based on the roles of different employees, controlling who can view, modify, or delete financial information.

By managing access rights, store owners can prevent unauthorized resource access and ensure that sensitive data is handled responsibly, reducing the risk of internal fraud and data breaches.

Point-of-Sale (POS) Integration

POS integration in cloud-based accounting software allows C-stores to connect their point-of-sale systems seamlessly with their accounting platforms. This integration automatically transfers sales data into the accounting system, reducing manual data entry and errors.

It ensures that financial records are always up-to-date, providing accurate insights into sales trends and inventory levels, which helps make informed business decisions and improve operational efficiency.

The Future of Cloud-Based Accounting in Convenience Stores

Looking ahead, the future of cloud-based accounting in convenience stores is filled with exciting possibilities.

Robust technologies like artificial intelligence, machine learning, and predictive analytics enhance the capabilities of accounting solutions. It provides store owners with even more powerful tools to drive growth, optimize operations, and stay ahead of the competition.

Moreover, accounting will play an increasingly integral role in supporting the success of convenience stores by meeting the changing consumer preferences and market dynamics. Unleash the power of cloud-based accounting to drive long-term growth, profitability, and sustainability in an ever-changing business landscape of convenience stores.

Hisably Empowers the C-stores’ Accounting Operations

Unlock the power of Hisably, a cutting-edge cloud-based accounting solution designed specifically for convenience stores. It transforms your store’s operations by automating inventory management, sales tracking, and financial reporting – all through an easy-to-use platform.

The platform facilitates you with all the benefits and features mentioned above by ensuring streamlined and efficient accounting operations.

Gain real-time insights into your cash flow, adjust inventory with precision, and leverage detailed reports and analytics to drive your business decisions. Say goodbye to manual errors and wasted time. Take control of your store’s future today.

Ready to streamline your operations and boost profitability?

Schedule a free Hisably demo and experience the difference it can make for your convenience store.